ON THE BLOG

WHEN PHARMACY VISITS DON’T GO AS PLANNED…

Many of the calls and questions I get from clients is in reference to prescription drug coverage. Sometimes, trips to the pharmacy can cause additional headaches, but there may also be some things you can do as a consumer to help make sure you are being given all of the options [...]

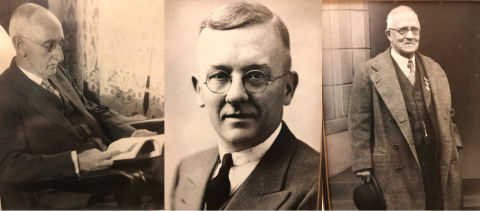

150TH ANNIVERSARY CELEBRATION: 1869-2019

CELEBRATING 150-YEARS OF RELATIONSHIPS Three years after the Civil War ended, two Fullerton brothers put together a business plan to open an independent insurance agency in Wooster, Ohio by 1869, representing the Ohio Farmer's Insurance Company (Westfield) and, by the turn of the century, the firm was in the capable hands [...]

THE VALUABLES BOX

A mere sixty years ago it was still popular to safeguard insurance policies and other valuble papers in a "valuables box." These boxes were fire-proof, might have contained a combination, key or similar lock, and often were just large enough to accommodate a small stack of tri-folded documents. "Back in the [...]